The potential impact of cyber attacks on the economy of the world’s largest cities has risen by nearly 9% in the last year, according to the 2019 update of the Global Risk Index from the Centre for Risk Studies at Cambridge Judge Business School, published today (4 December). Cyber risk has now risen from seventh to sixth place among global threats in the index.

The research by the Centre for Risk Studies is unique in making an annual quantification of the potential GDP impact of unpredictable shocks on the world’s most prominent cities. The 2019 update to the Global Risk Index sees a uniform rise in GDP@Risk across all the 279 world cities that make up the index and more significant increases in risk for some urban centres.

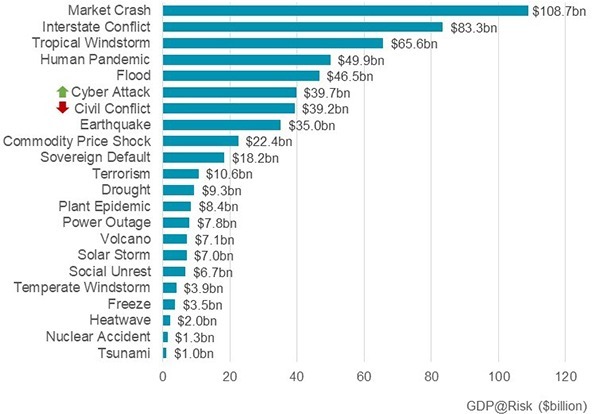

The Global Risk Index compiles the impacts of 22 types of threats into a single, annual measurement of economic loss, GDP@Risk. In addition to the continuing rise of the potential severity of cyber attacks, the 2019 index shows a sustained likelihood of commodity price volatility and of high levels of risk from geopolitical events and financial crises.

The estimated potential impact of cyber attacks has risen significantly since 2015 when the Centre for Risk Studies compiled its first Global Risk Index. The capacity for cyber attacks to cause severe economic damage is on the rise from the increasing number and severity of incidents, such as the NotPetya and WannaCry events in 2017. Cyber protection capabilities are slowly improving in response to the proliferation of cyber criminals. The Centre has explored the current and evolving cyber risk landscape in the Cyber Risk Outlook 2018, published earlier this year.

Overall, the Centre for Risk Studies’ analysis shows a 5.6% increase in GDP@Risk from 2018 to 2019. GDP@Risk is a calculation of each city’s economic output and its exposure to particular threats associated with its geography and type of economy offset by its resilience in recovering from them.

The underlying analytics provide a methodology that governments, infrastructure providers, insurers and development organisations can use to quantify the economic value of improvements in city resilience. The Global Risk Index can also aid corporates in understanding their own exposure to the range of threats modelled. The Centre has explored current corporate risk views, practices and mitigations in a report with the Institute of Risk Management (IRM), published in November 2018.

Academic Director of the Centre for Risk Studies Professor Daniel Ralph, comments:

“Shocks to the global economy are largely inevitable, resulting in real losses to the economy and to corporates. The Global Risk Index provides a framework for governments and organisations to evaluate their exposures to such catastrophes, enabling data-driven decisions on potential mitigations and strategic planning for the future.”

Top threats

The top three classes of threats in the 2019 Global Risk Index by size of potential impact, are:

- natural catastrophes: GDP@Risk of $174 billion

- financial, economics and trade: GDP@Risk of $149 billion

- geopolitics and security: GDP@Risk of $140 billion.

The complete ranking of the 22 individual threat types in the Cambridge Global Risk Index 2019 is shown below.