By Marwin Mönkemeyer, CERF/CCFin Research Associate, Cambridge Judge Business School, University of Cambridge

Investor portfolios remain severely home-biased

Investors’ preference for domestic over foreign assets is well documented in the literature on international portfolio allocation (French and Poterba, 1991). As a result, investors often do not take full advantage of the substantial benefits of international diversification and hold far more domestic securities than would theoretically be optimal.

Historically, the systematic tendency of investors to overweight their home markets has long been attributed to market frictions such as transaction costs, regulatory barriers, and taxes. However, as global financial markets have become more integrated, but the ‘home bias’ persisted, studies increasingly challenged these explanatory approaches.

In recent years, the field of international finance has broadened its perspective to include psychological and sociological constructs to explain investor behaviour. In a recent study, my co-authors and I build on this paradigm shift and introduce a new factor that helps explain cross-border equity investment: social trust (or lack thereof).

Understanding the influence of social trust for economic outcomes

Economists have long recognised that social trust is particularly important for economic success in society (Arrow, 1972; Coleman, 1990). Consistent with Nobel laureate Kenneth J Arrow’s notion that “virtually every commercial transaction has an element of trust in it” (Arrow, 1972, p.357), social trust influences a wide range of economic outcomes. It paves the way for economic growth (Knack and Keefer, 1997) and enhances firm performance (Lins et al, 2017). It affects the size and structure of firms (Bloom et al, 2012), government regulation (Aghion et al, 2010), and even the terms of bank loans (Hagendorff et al, 2023), to name but a few examples.

Existing evidence suggests that social trust lowers the cost of trust-sensitive transactions, that is, economic interactions in which parties rely on the future actions of others (Knack and Keefer, 1997). This finding provides support for the conjecture that trust might also affect investment decisions since they are characterised by the exchange of money for future promises and require the belief in repayment as agreed.

The research study: exploring the link between trust and investment

To empirically examine the role of trust in portfolio allocation, we analyse a global sample of more than 8,000 institutional investors from 33 countries investing in equities in 84 host markets from 2000 to 2017.

The appropriate measure of social trust

The literature differentiates between personalised trust, which is trust in a specific person, and generalised trust, which is trust in an unknown member of a larger group, such as fellow citizens or people from other countries. For markets and institutions to function correctly, it’s essential for people to trust strangers, referred to as generalised (social) trust. Accordingly, our study focuses on generalised trust within an institutional investor’s home market.

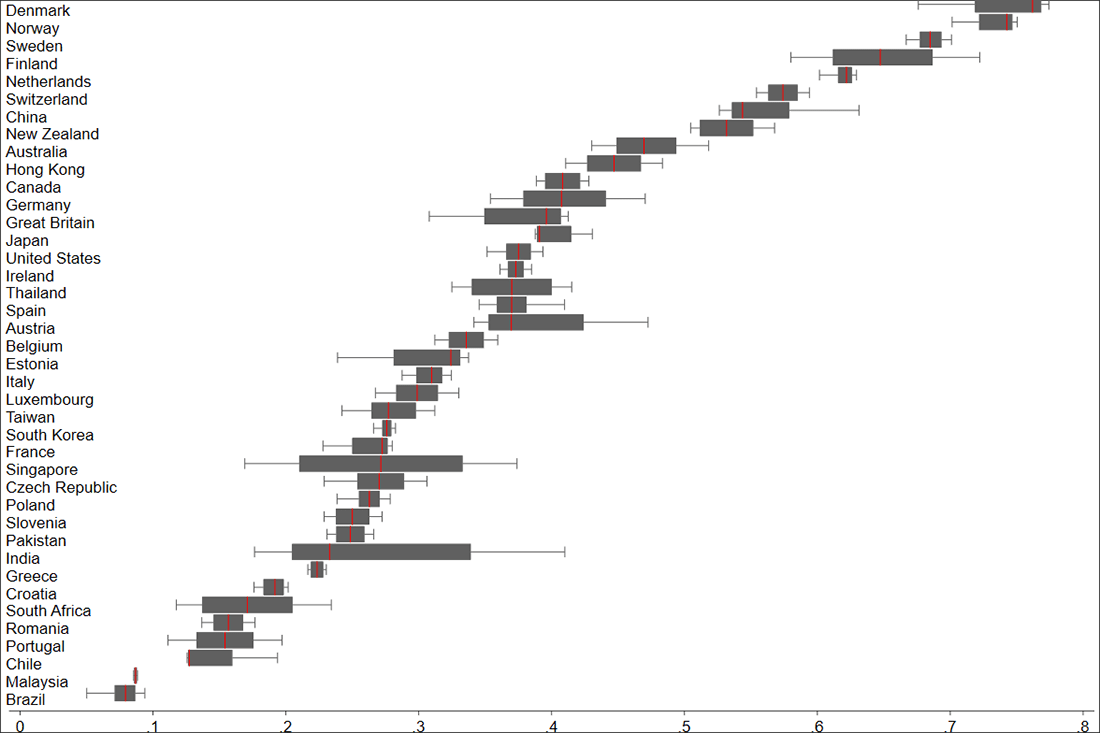

We draw on existing surveys, where trust is defined as the percentage of respondents answering “Can be trusted” to the question “Generally speaking, would you say that most people can be trusted or that you can’t be too careful in dealing with people?” Trust shows considerable variation in the cross-section of countries, ranging from 3.17% for the Philippines to 77.42% for Denmark.

Figure: Boxplot diagrams of social trust scores across countries. Source: Drobetz et al (2023).

Trust reduces underinvestment in foreign equity

The key finding of our study is that institutional investors from high-social trust countries are less prone to underinvesting in foreign stocks. This has implications for international portfolio diversification: Social trust is different from mere “blind” trust as we document positive consequences for investors’ international risk exposure. Trust leads to a better risk-return trade-off in investor portfolios, as indicated by increased Sharpe ratios.

Information asymmetry: trust as a key moderator

Information asymmetry, the notion that some parties possess more information than others, is a prevalent issue in equity markets. Proxying for information asymmetry in the target markets along different dimensions, we show that trust plays a more important role in opaque information environments (Guiso et al, 2008). Social trust emerges as a partial solution to the information asymmetry problem, which is particularly pronounced in foreign equity investing. Our results support an information-based explanation of the relationship between social trust and foreign stock investment.

Social trust as a substitute for formal institutions

We also analyse the joint effect of formal and informal institutions in the context of portfolio allocation. The analysis is important due to the diversity of formal institutions around the world, which is likely to condition international portfolio allocations. Our empirical evidence shows that trust does not mitigate foreign bias per se, but only when the quality of host-country formal institutions is poor. We conclude that the informal institution of social trust can serve as a substitute for the quality of the host country’s formal-institutional framework in international portfolio decisions.

What are the implications for investors and policymakers?

Trust matters in portfolio allocation – it mitigates inefficiencies in cross-border portfolio allocations created by information asymmetries. Investors should recognise that the level of social trust affects their portfolio decisions, and portfolio risk-return trade-off. Policymakers and regulators are well advised to strengthen formal institutions to counterbalance low social trust, making their jurisdictions more appealing for foreign investments.

This blog is based upon a recent Journal of Economic Behavior and Organization research paper I co-authored with colleagues from the Universities of Hamburg and Salamanca, and Leuphana University Lüneburg.

Featured academic

Marwin Mönkemeyer

Research Associate, Cambridge Centre for Finance (CCFin) and Cambridge Endowment for Research in Finance (CERF)

Featured research

Drobetz, W., Mönkemeyer, M., Requejo, I. and Schröder, H. (2023) “Foreign bias in institutional portfolio allocation: the role of social trust.” Journal of Economic Behavior and Organization

Article references

Aghion, P., Algan, Y., Cahuc, P. and Shleifer, A. (2010) “Regulation and distrust.” Quarterly Journal of Economics, 125: 1015-1049

Arrow, K. (1972) “Gifts and exchanges.” Philosophy and Public Affairs, 1: 343-362

Bloom, N., Sadun, R. and Van Reenen, J. (2012) “The organization of firms across countries.” Quarterly Journal of Economics, 127: 1663-1705

Coleman, J. (1990) “Home bias in open economy financial macroeconomics.” Journal of Economic Literature, 94: 64-115

Drobetz, W., Mönkemeyer, M., Requejo, I. and Schröder, H. (2023) “Foreign bias in institutional portfolio allocation: the role of social trust.” Journal of Economic Behavior and Organization, 214: 233-269

French, K. and Poterba, J. (1991) “Investor diversification and international equity markets.” American Economic Review, 81: 222-226

Guiso, L., Sapienza, P. and Zingales, L. (2008) “Trusting the stock market.” Journal of Finance, 63: 2557-2600

Hagendorff, J., Lim, S. and Nguyen, D. (2023) “Lender trust and bank loan contracts.” Management Science, 69: 1758-1779

Knack, S. and Keefer, P. (1997) “Does social capital have an economic payoff? A cross-country investigation.” Quarterly Journal of Economics, 112: 1251-1288

Lins, K., Servaes, H. and Tamayo, A. (2017) “Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis.” Journal of Finance, 72: 1785-1824