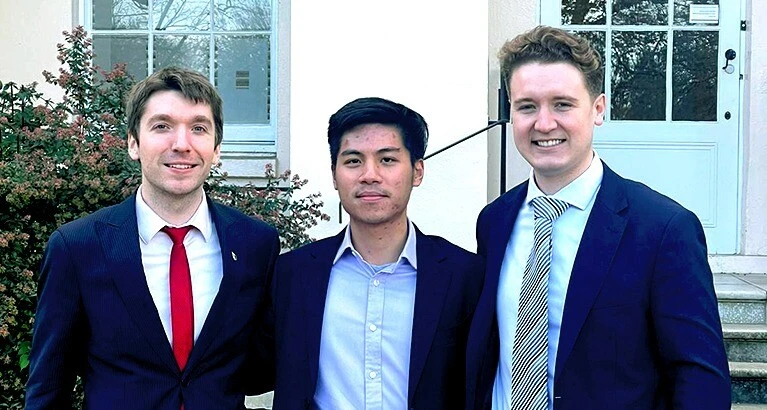

As the academic year kicked off with a flurry of induction lectures and networking sessions, the students on the Cambridge MFin programme were already busy building connections and preparing for unique opportunities. One such opportunity came in the form of an invitation from London Business School’s Investment Management Club, to attend their 2023 Investor Insight Summit. For a team of 3 MFin students – Ross, Rodolfo, and myself – it was a chance to pitch PayPal, a company we were passionate about and believed in.

Our team brought a diverse set of skills and experiences to the table. Ross, who had previously worked as an auditor at PwC, specialised in fintech and payments. Rodolfo, an investment analyst at a Latin American family office, brought valuable insights from his role. I have a background in valuations at PwC and experience in asset management. Drawing from different continents and industries, we collaborated to develop a compelling pitch.

Perfecting our pitch

Our pitch was built on 3 solid investment theses, supported by a discounted cash flow valuation that substantiated our investment. Time was of the essence, and we knew the importance of efficient teamwork. Thanks to insights gained from our Equity Research Project module, we understood the significance of keeping our presentation informative without overwhelming it with excessive details. We valued honesty and constructive feedback within our team, ensuring that every suggestion led to a refined pitch and presentation. We were aware of the high standards set by our competitors, but we were confident in the strength of our investment proposal. Our goal was clear: deliver a concise and impactful 10-minute pitch.

The London Business School Investor Summit spanned 2 days, from 23 to 24 November. To ensure we were well-prepared, we arrived in London a day ahead of the competition. After a healthy breakfast on the day of the competition, we mentally rehearsed our pitches while strolling through Regent’s Park, determined to make the most of our opportunity.

Competition time – a winning investment proposal

By 16:30, the time of our arrival at the event, we had fine-tuned our pitch to perfection. In the initial stage of the competition, teams were divided into 3 groups. The winners from each group would advance to the final round to compete for the ultimate prize. Our competitors included teams from ESADE Business School and London Business School, and we faced a panel of judges consisting of portfolio managers and analysts from prestigious firms such as Azura Partners, NinetyOne, Ranmore Fund Management, Citibank, and Brown Advisory.

Our pitch was assessed based on the strength of our investment theses, our ability to identify risks, the effectiveness of our delivery and responses to questions raised by the panel. To our immense satisfaction, the panel of judges unanimously found our pitch to be outstanding. It was a moment of great pride, as it signified that our hard work and dedication had paid off.

Building valuable skills and knowledge

The following day at the summit was equally enriching. We had the privilege of listening to economists and portfolio managers share their insights on the global economic outlook, portfolio positioning, and developments in emerging markets and ESG (Environmental, Social and Governance).

In conclusion, our journey to the London Business School’s Investor Insight Summit was an unforgettable experience that exemplified the collaborative spirit, dedication, and commitment to excellence that define the MFin programme at Cambridge. Pitching PayPal was more than a competition; it was an opportunity to showcase the skills and knowledge we have gained throughout our programme and to learn from industry experts. As we look ahead to our future careers in finance, we carry with us the invaluable experiences and lessons from this remarkable journey.

About the blog authors

Hanson Hong, MFin 2023

Bachelors in Banking and Finance, University of London

Hanson joined the Cambridge MFin with 3 years of experience in Asset Management and Financial Advisory. Hanson is passionate about global equity markets. Outside of finance, Hanson loves music, tennis and vintage watches.

Rodolfo Prado, MFin 2023

Bachelors in Industrial Engineering, Universidad Adolfo Ibáñez

Rodolfo joined the Cambridge MFin with 4 years of experience in Private Wealth Management working as an investment professional for one of the biggest single Family Offices in Chile.

He has a quantitative background and has been a TA for Thermodynamics and Electromagnetism. Rodolfo is an ANID-Cambridge Trust Scholar.

Ross Nalson, MFin 2023

Bachelors in Accountancy, University of Nottingham

Ross is a qualified chartered accountant and has 2 years of auditing experience with PwC UK where his focus was within the Fintech and Media industries. He enjoys golf and fishing.

Related content

The Equity Research Project allows students to apply their MFin knowledge and skills by creating an investment thesis and recommendation for a listed company.

Recent MFin student blog posts

In her first few weeks at Cambridge Judge Business School, Aaryani Dogra reflects on the powerful beginning of her Master of Finance journey. From walking the historic courtyards to hosting celebrated speakers and finding community through student groups, she shares how the MFin programme is already shaping her into a thoughtful leader and global citizen.

Nita transitioned from strategy consulting to sustainable finance, driven by a personal mission to protect the planet for future generations. At Cambridge, she deepened her expertise in climate finance and circular economy, while balancing motherhood and study with resilience and community support.

In this reflective piece, Oseremen Irabor, a recent MFin graduate shares how his year at Cambridge transformed not just his finance toolkit, but his mindset, relationships and leadership style.