The Cambridge Centre for Alternative Finance, a part of Cambridge Judge Business School at the University of Cambridge, announced an update to the Cambridge Digital Money Dashboard, an open-access tool developed to provide empirical data and analysis on privately issued stablecoins. This latest update offers policymakers, financial authorities, industry professionals and the general public new data and visualisations on the geographical flows of stablecoins as well as an extended overview of regulation for more jurisdictions.

This new update was made possible through a joint work with Chainalysis, a blockchain data platform specialising in on-chain data analytics for investigations and compliance and cutting-edge research into the geography of digital assets.

“Despite privately issued stablecoins being global in nature, stablecoin transactions can exhibit unique geographical patterns influenced by local market dynamics, well-established cross-border payment corridors and jurisdiction-specific regulatory requirements,” said Bryan Zhang, Founder and Executive Director of the Cambridge Centre for Alternative Finance. “As the stablecoin industry evolves and countries continue to develop their regulatory regimes, there is a strong need for data and information on the geographical flows of stablecoins. We are now able to bridge this data gap thanks to our collaboration with Chainalysis.”

“The data and interactive visualisations of stablecoin flows create a foundation for further research on the impact of stablecoins on financial inclusion, international payments, remittances, potential risks to local and regional financial systems, and the impact of regulation on the digital asset landscape. In addition to the geographical stablecoin flows, we have added regulatory overviews for 4 new jurisdictions, offering users a comprehensive overview of regional differences,” explained Roman Proskalovich, Emergent Money Systems Research Lead at the CCAF.

“As the regulatory landscape for digital assets continues to evolve, access to comprehensive data has become fundamental. The Cambridge Digital Money Dashboard visualises our data estimates on the geographic flows of stablecoins in a manner that provides a unique foundation to drive informed decision-making. Chainalysis is proud to collaborate on this initiative, giving insight into the complexities of the digital asset ecosystem for policymakers, regulators and industry participants,” said Jonathan Levin, co-founder and CEO at Chainalysis.

Key updates in the Cambridge Digital Money Dashboard

1

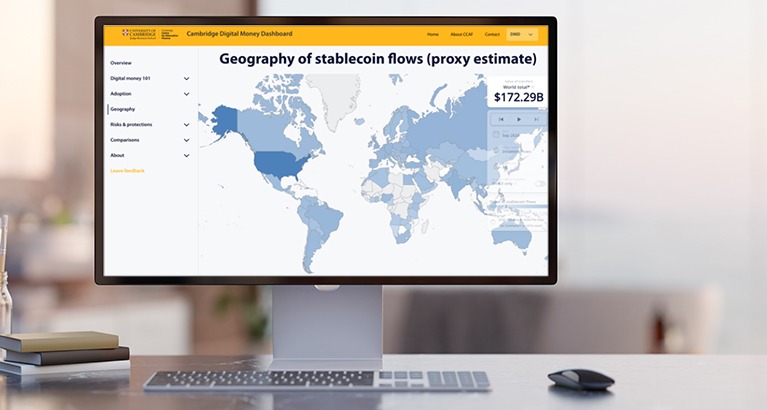

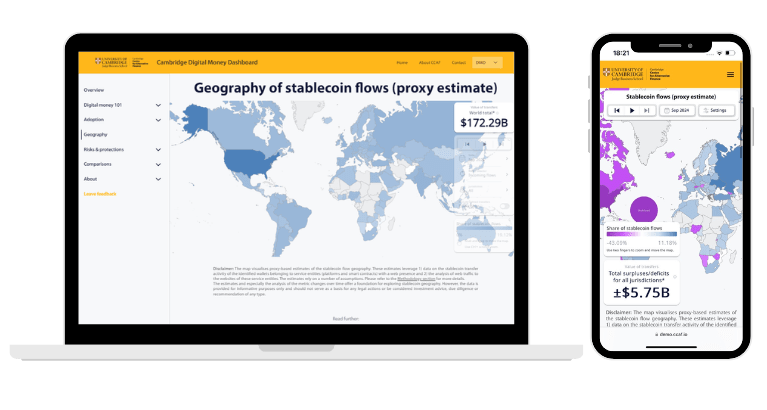

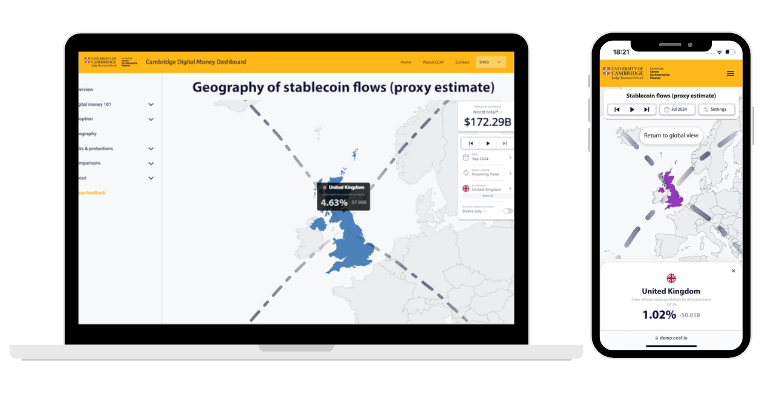

Geography of stablecoin flows

The updated dashboard now includes a comprehensive map visualising the estimated shares of different countries in global stablecoin flows covering the past 36 months. Countries are shaded in different colours of blue with darker blue tones highlighting countries with higher shares. Users can explore data on incoming, outgoing and net flows for individual jurisdictions. Data can be tracked over time using the map’s time-lapse feature.

Users first see the total US dollar denominated amount of incoming global stablecoin transfers for the reference month. When a user clicks on a specific country, they are shown the percentage share of incoming flows to that country. The country tooltip card which appears above the country also shows the estimate of inflows in absolute values. Additionally, the settings menu to the right of the map allows users to switch between different metrics and time periods or search for another jurisdiction.

2

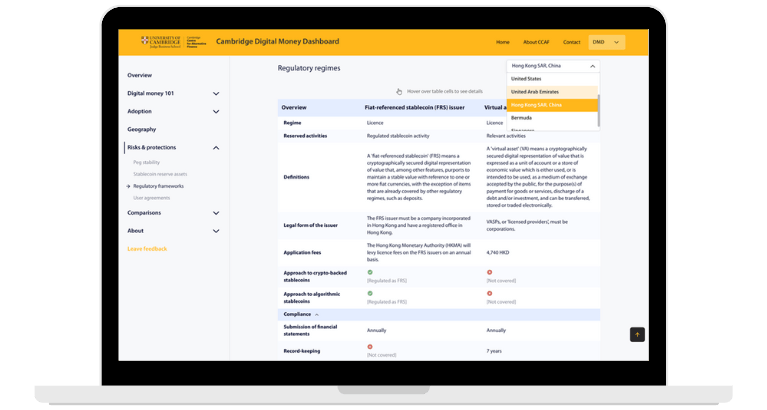

Enhanced regulatory overview

Building on the comprehensive overview of stablecoin regulation in the UK, US, Singapore and the European Union in the first iterations of the dashboard, this iteration expands its coverage to include regulatory frameworks in Hong Kong, the United Arab Emirates, the Bahamas and Bermuda.

Each of the 4 new jurisdictions added to the Risks & Protections section has either introduced or are in the process of introducing comprehensive stablecoin regulation. They have taken a range of approaches, and the comparison is intended to allow policymakers to explore the finer regulatory details and cryptoasset companies to assess the risks and opportunities in each jurisdiction.

Reflections on the latest dashboard updates

The Cambridge Digital Money Dashboard is a research output of the Cambridge Digital Assets Programme (CDAP), a multi-year research initiative hosted by the CCAF in collaboration with 16 prominent public and private institutions. The Programme provides the datasets, digital tools and insights necessary to facilitate a balanced public dialogue about the opportunities and risks a growing digital asset ecosystem presents. The ultimate objective is to help inform evidence-based decision-making and regulation through open-access research.

CDAP’s founding institutional collaborators are (in alphabetical order) Bank for International Settlements (BIS) Innovation Hub, British International Investment (BII), Dubai International Finance Centre (DIFC), EY, Fidelity Investments, UK Foreign, Commonwealth & Development Office (FCDO), Inter-American Development Bank (IDB), International Monetary Fund (IMF), Invesco, MSCI, Visa and World Bank. 4 new members have recently joined the effort: NatWest, Switzerland’s State Secretariat for Economic Affairs (SECO), Euroclear and the Depository Trust & Clearing Corporation (DTCC). The CDAP Emergent Money Systems research stream is advised and co-chaired by Gina Pieters and Marcelo Prates.

The latest release of our Dashboard is a major step forward in delivering on our vision of an accessible and comprehensive platform with unique insights on the evolution of all forms of Digital Money.

Transparency of the backing to stablecoins is a priority of the BIS Innovation Hub. The Cambridge Digital Money Dashboard is a useful open-sourced tool, providing insights into historical trends and stability factors. We encourage further development of open-sourced tools in this space.

Understanding the way stablecoins are used, backed, and regulated are important elements to better contextualise benefits and risks. The Cambridge Digital Money Dashboard could be a relevant tool for policymakers to use as part of a broader toolkit to inform their approaches.

Increasing the volume of available data on the stablecoin market will benefit all stakeholders in the ecosystem, and should promote greater understanding of the sector. Crypto is a huge growth market and it is positive to see progress being made to increase transparency and visualisation via new tools.

The Cambridge Centre for Alternative Finance continues its leadership and eminence in research that have helped all prepare for – and understand – the future of finance. The CCAF’s online tools lead in both foresight and scale; the Cambridge Digital Money dashboard provides essential data on stablecoin supply, adoption, values and movement. With the expanded geographical flows and regulatory frameworks provided in the latest update, we use it to inform vital insights for both our research and practices in Accenture’s global consultancy.

Cambridge Digital Money Dashboard

The Cambridge Digital Money Dashboard is an open-access digital tool policymakers, financial authorities, industry professionals and the general public.