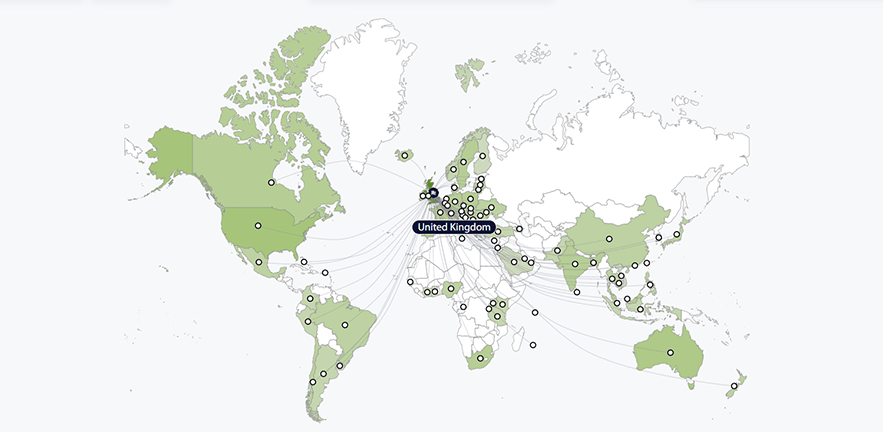

The global footprint of the UK’s fintech industry is visualised in a new digital map launched by the Cambridge Centre for Alternative Finance in collaboration with Innovate Finance.

A new, free-to-access digital mapping tool that visualises the overseas footprint of UK-based fintechs has been launched today at the Innovate Finance Global Summit in London. This digital tool was created by the Cambridge Centre for Alternative Finance (CCAF) at Cambridge Judge Business School, in collaboration with Innovate Finance with the support of UK Department of Business and Trade (DBT), the City of London Corporation and the UK Foreign, Commonwealth and Development Office (FCDO).

The “Mapping the Global Footprint of UK Fintechs” project provides an indicative and interactive visualisation to showcase the scope and strength of the UK fintech industry’s global connectivity and expansion. Using data collected from 152 self-reported survey responses, coupled with open-sourced data for a further 400 UK-based fintechs, the digital map serves to inform future strategic decision-making by firms, regulators, policymakers and other stakeholders in the UK and around the world.

Easily accessed insight

The digital tool displays the ‘footprint’ of UK fintech firms across the globe allowing users to easily identify where these companies are operating from and offering services to. Users will also be able to search for specific companies, countries of interest or market segments using the search function or navigation bar, providing quick and easy access to the information they need.

The digital tool shows that of 558 UK-based fintech firms mapped (e.g. fintechs that have the UK as their registered headquarters or as place of incorporation), 209 (37%) have an operational presence outside of the UK (either incorporated legal entities, physical offices, registered subsidiaries or joint ventures). Further, 318 UK firms (57%) are providing products or services outside of the UK.

Geographic and sector segmentation

The top 10 overseas jurisdictions in which UK-based fintech firms have an operational presence and connectivity are the United States, Singapore, Australia, Spain, Germany, United Arab Emirates, France, Netherlands, Ireland and India. The top 5 business models represented by these firms are digital payments, enterprise technology provisioning, regtech, cryptoasset exchange and digital lending. The top 3 regions for both UK-based fintechs to expand to and offer products and services from are Europe, North America and the Asia-Pacific region.

Launched at the Innovate Finance Global Summit, the initiative has also been supported by key UK fintech ecosystem stakeholder groups such as FinTech Scotland, FinTech Wales, FinTech Northern Ireland, FinTech North, FinTech West, SuperTech West Midlands, Level39, London & Partners and Fintech Alliance.

Informing decision making

“We believe this to be the first time that such a comprehensive mapping and visualisation of the UK fintech industry’s overseas expansion and connectivity has been made publicly available to inform market development and evidence-based policymaking,” says Bryan Zhang, Co-founder and Executive Director of the CCAF. “Fintech and other forms of digital financial services are well-positioned to expand overseas in order to grow and scale, empirical data is therefore needed to help key stakeholders to work together and create a more enabling environment for them to go global.”

“This interactive digital tool is a keen illustration of the strength, connectivity and expansion of the UK fintech sector, demonstrating the industry excellence and global leadership in financial innovation by UK fintechs,” says Janine Hirt, the CEO of Innovate Finance. “We are delighted to have been able to collaborate with the CCAF and other partners to create this excellent showcase that aims to provide visibility, clarity and evidence to enable the next chapter of UK fintech growth and expansion to overseas markets.”