While much research exists on the use of innovative financing mechanisms (eg impact investing, blended finance and public-private partnerships) by philanthropists in the global North, the nascent rise of these models within philanthropies in the global South remains under-reported. This new report seeks to address this gap, exploring the adoption of innovative finance mechanisms by philanthropists in Asia and the Middle East, and the potential for – and regulatory and legal barriers to – their deeper integration into philanthropy across these regions. Importantly, the report also looks at precursors to innovative finance among Asian and Middle Eastern philanthropies, highlighting that while the terminology and contemporary shape of innovative finance are recent trends coming from the global North, key aspects of these practices can be seen in the history of philanthropy in Asia and the Middle East.

Creating a more sustainable impact

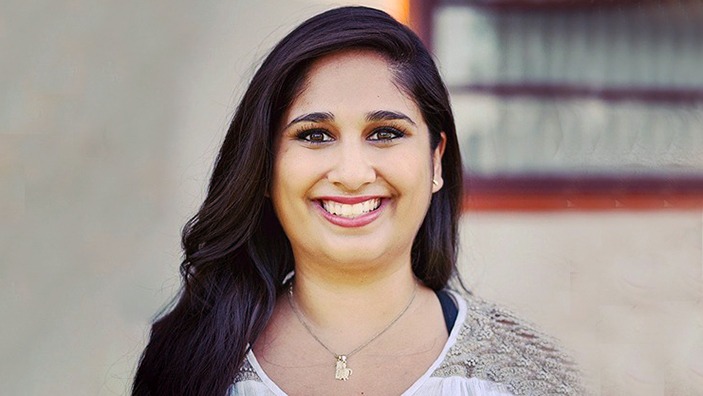

As Sangeetha Watson from the AVPN (formerly Asian Venture Philanthropy Network) notes in the report, many regional forms of innovative financing have “been in play for a long time, and are now slowly starting to gain wider traction.” In some cases, this is due to the arrival of a new wave of philanthropists, who are asking “how do I line up my business and investment interests with my philanthropic endeavours for more sustainable impact?”

The report is based on documentary data collection and interviews with key philanthropic intermediaries in Asia and the Middle East, incorporating short case studies of AVPN’s ‘Continuum of Capital’ model, the history of microfinance in Asia and the Indonesian Impact Alliance. It further provides a series of recommendations for philanthropists and foundation staff working with innovative finance in these regions.

Report a useful resource for philanthropists, foundation staff and advisors in Asia and the Middle East

The report serves as a useful resource for philanthropists, foundation staff and advisors in Asia and the Middle East interested in adopting or expanding the use of innovative financing mechanisms in their practice, and makes an informative addition to existing research on innovative financing for philanthropy in different global contexts.

Featured research

The Report: Philanthropy and Innovative Financing in Asia and the Middle East

This research was supervised by Dr Shonali Banerjee, Visiting Research Fellow, and Clare Woodcraft, Visiting Fellow, of Cambridge Judge Business School. The report is authored by Etien Jasonson (London School of Economics and Political Science) and edited by Dr Jessica Sklair (School of Business and Management, Queen Mary University of London).