by Hormoz Ramian, Research Assistant, Cambridge Centre for Finance and Cambridge Endowment for Research in Finance

The negative interest rate has been among the frontier policies to counter the recent economic downturns. The 2020 pandemic resurfaced the policy’s role that was originally deployed to assuage prolonged slowdowns associated with the aftermath of the 2008 financial crisis. While lowering the cost of financing is a well-established policy initiative in response to adverse economic outcomes, the effective pass-through implications of the negative interest rates through the financial intermediaries remains an open question.

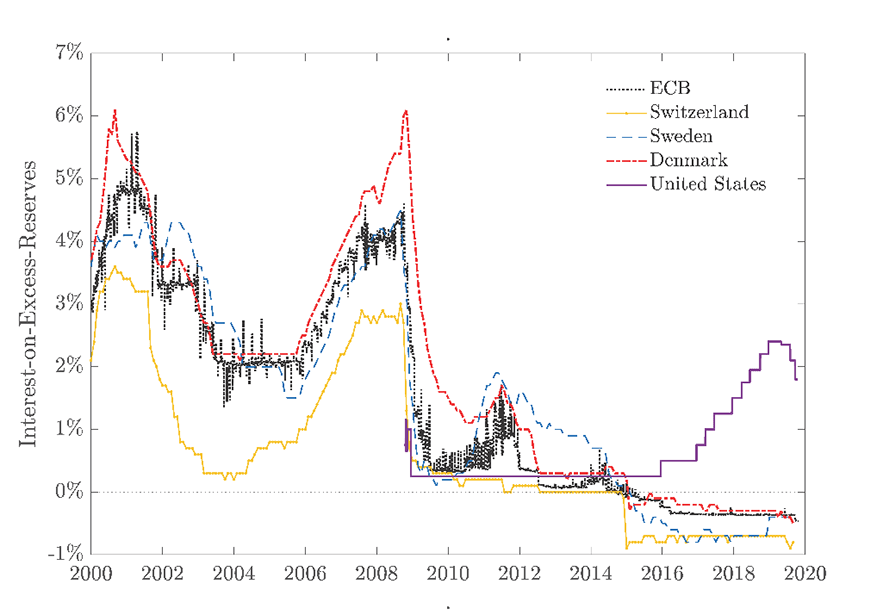

Policymakers examine how negative interest rates lead to real economic implications through the financial intermediaries. The interest rate policy (alternatively known as the bank rate or the federal funds rate) is primarily a monetary policy. Nevertheless, its tight relationship with the interest-on-excess-reserves (IOER), paid on oversized excess reserves held by the banking institutions, generates substantial impacts on the overall performance of the banks and their lending. This provides motivation to first, investigate how the negative interest rate policy is translated to an ultimate lending rate for the real economy through the banking institutions. Second, the tight relationship between the main monetary policy and the IOER provides motivation to examine how the interaction amongst policy initiatives by the monetary and financial regulatory authorities leads to welfare implications.

Over the past decade, oversized excess reserves of the banking system have comprised over one-third of the total assets of major central banks in charge of 40 per cent of the world economy. Between January 2019 to October 2019, depository institutions in the United States held $1.41 trillion of funds in excess reserves that accounts for over 40 per cent of the total balance sheet size of the Federal Reserves. Over the same period, the European Central bank held over €1.9 trillion in excess reserves forming a slightly smaller share relative to the consolidated balance sheet of the Eurosystem. The similar pattern holds for the Danish National Bank, the Swiss National Bank, the Sveriges Riksbank, and the Bank of Japan.

Evidence shows that in July 2020, excess reserves of the depository institutions accounted for nearly 30 per cent of the total assets of the Federal Reserves and the European Central Bank (ECB). The cross-dependency between IOER and bank capital regulation is an important consideration with welfare implications because conflicting effects among the two policies may lead to over-regulation of the banking sector and disruptions in credit flow to the real sector. Alternatively, two policies may lead to under-regulation and re-expose the banking system to heightened default risk and possibly failures with socially undesirable outcomes. The aftermath of the 2008 financial crisis highlighted the lack of analytical frameworks to integrate multiple policies and assess their real economic implications. Policymakers constantly address distortions associated with each aspect of the economy with individual policies. Nonetheless, the policymaker’s ability to provide welfare gains through a broad range of levers is limited by the understanding of the interconnecting channels among policies.

A quintessential feature of IOER is its dual role. This policy is decided by the monetary authority and, historically, it has been heavily correlated with the main monetary policy. In the United States, the Federal funds rate and IOER are heavily correlated. This strong relationship is a stylised fact that holds among other advanced economies ranging between 94 and 99 per cent. When the monetary authority targets reserve management, IOER simultaneously affects banking institutions’ balance sheets to a great extent which strengthens the connections between the main monetary policy and the capital regulation. Existing studies in macro-finance and banking literature investigating the implications of the negative interest rate policy often focus on the interconnections between the policy and the assets side of the banking institutions. This strand of the literature provides a limited prediction about how the negative interest rate policy is passed through the real sector because when rates are negative, the exceedingly steep marginal utility of consumption of the depositors limits the bank’s ability to pass the negative rates to its depositors. An alternative strand of literature has tackled this shortcoming through partial equilibrium approaches and shows that given exogenous deposit holdings, the negative interest rate policy leads to lower cost of borrowing for the real sector. Nonetheless, such approaches fail to consider the downsides of the negative interest rate policy as the rate may fall indeterminately.

These shortcomings provide the motivation to consider both sides of the banking institutions balance sheet into the policy initiative to determine the interest rate policies that passes through the bank borrower (businesses) and its lenders (depositors). When interest rates are positive, policymaker’s decision to lower IOER is followed by an almost proportional fall in the bank deposit rate. Because the banking sector holds only a fraction of the deposits invested in reserves, a proportional decrease in the deposit rate in response to falling IOER leads to a faster drop in interest expenses on deposits, than the loss of interest incomes from reserves. The banking sector extends lending to the borrowers as a result of lower default risk when IOER falls and subsequently, the bank capital regulation tightens to adjust for the added risk to banks’ assets.

However, when IOER becomes very low, or possibly negative, the deposit rate exhibits an increasingly flatter response to further changes in IOER because deposit investors require a marginally positive compensation for time preference to forego current consumption. When bank deposit rate is increasingly nonresponsive to any further reductions in the policymaker’s negative interest rate, loss of interest incomes from reserves exceeds lowered interest expenses on deposits. The banking institutions respond to increased default risk due to higher net interest expenses by lowering lending to maintain their shareholder value and then bank capital regulation loosens. This indicates that lower IOER dissuades the banking sector from over-relying on idle excess reserves with an expansionary effect on the real economic output only when lower rates lead to lower default risk, otherwise lowering IOER generates counterproductive results by worsening this overreliance problem and becomes a contractionary economic impact. This finding provides a motivation for the monetary and financial regulatory policymakers to act jointly to provide welfare gains to the society.