Research centre news

New study: industry associations boost fintech ecosystems

Industry associations are valuable contributors to the fintech ecosystem in many jurisdictions globally. They play an important and prominent role in a number of the fintech ecosystems enablers. For example, through representing the voice of the fintech industry, they engage with financial authorities to provide input and feedback on the regulatory environment.

Research centre news

New report: digital finance linked to MSME growth

Digital finance providers enhance access to credit for businesses, particularly for MSMEs operating in EMDE countries, resulting in improved business performance, a new report by the Cambridge Centre for Alternative Finance (CCAF) reveals.

Research centre news

Report: exploring wholesale central bank digital currencies

Report by the Cambridge Centre for Alternative Finance based on interviews with central banks and market participants examines how wholesale central bank digital currency initiatives are evolving in pilots and other developments around the world.

Research centre news

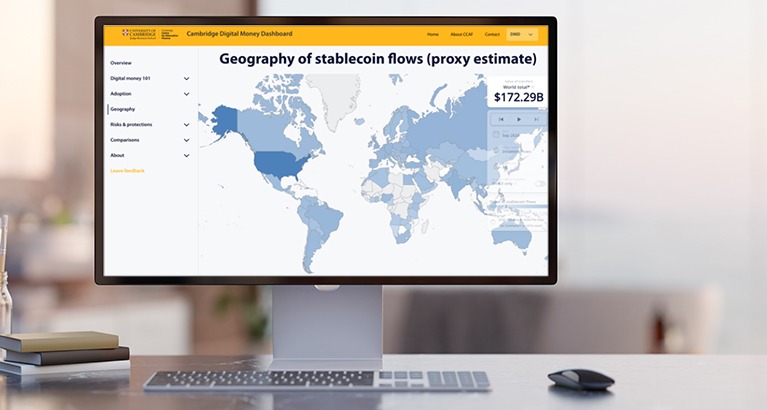

Digital tool sheds light on stablecoin flows and regulation

The Cambridge Centre for Alternative Finance (CCAF) at Cambridge Judge Business School launches an update to the Cambridge Digital Money Dashboard (CDMD), offering new insights into the geographical flows of stablecoins, as well as regulatory overviews for a wider set of jurisdictions.

Research centre news

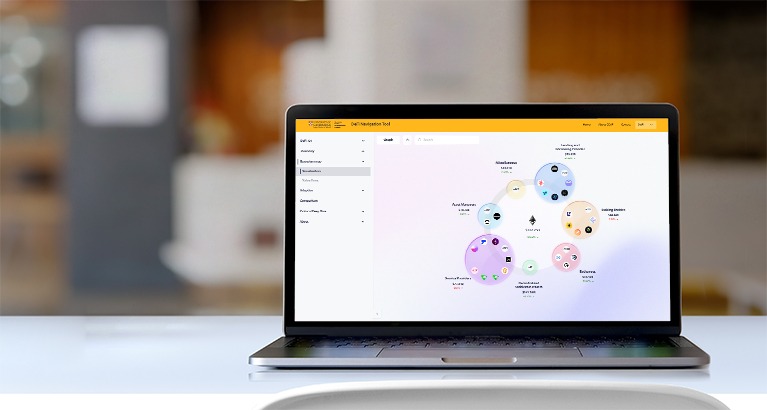

Cambridge launches digital tool to analyse decentralised finance

The Cambridge Centre for Alternative Finance (CCAF) at the Cambridge Judge Business School reveals the Cambridge DeFi Navigator (CDN) to provide empirical data and analysis on the decentralised finance (DeFi) ecosystem.

Research centre news

Open banking and finance gain global momentum

The global adoption of open banking and open finance continues to gain momentum, with both regulation-led and market-driven frameworks fostering greater access and innovation in financial services, a new report by the Cambridge Centre for Alternative Finance (CCAF) reveals.

Research centre news

New study: crypto regulation fragmented, emerging markets lag

Cryptoasset regulation remains fragmented, with emerging markets and developing economies lagging behind in global push, new Cambridge study reveals.

AI and technology

Suptech uptake drives consumer protection and financial inclusion

Cambridge Suptech Lab survey finds that uptake of supervisory technology (suptech) is driving rapid response in consumer protection and greater financial inclusion.

Programme news

Robert Wardrop, alternative finance pioneer and MBA lecturer

Professor Robert Wardrop talks about why his elective ‘New Venture Finance’ is the most popular choice on the MBA programme and why when he co-founded the Cambridge Centre for Alternative Finance (CCAF) in 2015, it was the first of its kind in the world. This article is part of our MBA Teaching Spotlight series.…

Research centre news

Bryan Zhang named to Financial Conduct Authority board

Bryan Zhang, Executive Director of the Cambridge Centre for Alternative Finance at Cambridge Judge, appointed as Non-Executive Director of the UK Financial Conduct Authority (FCA) board effective today (19 February).

Research centre news

New digital tool for tracking the development of stablecoins

Cambridge Centre for Alternative (CCAF) at Cambridge Judge Business School reveals the Cambridge Digital Money Dashboard (CDMD) to provide empirical data and analysis on privately-issued stablecoins.

Research centre news

How consumer demand continues to drive global fintech growth

Report by the Cambridge Centre for Alternative Finance at Cambridge Judge Business School and the World Economic Forum, launched at 2024 Davos Annual Meeting, highlights underpinnings of growth and future challenges for the global fintech industry.