Projects are a central feature of the Cambridge Master of Finance. They enable direct contact with the practitioner client and provide the opportunity for students to apply what they have learnt in the taught programmes to real world situations and problems.

There are 2 compulsory and one optional masters projects:

Equity Research Project

Takes place: December/January

Assessment: Presentation and report.

Working in groups, students research, write and present an investment thesis and recommendation on a listed company chosen by the MFin team. The report is designed to advise on the investment potential of that company and make an active recommendation to buy or sell shares in this company.

The team presents their recommendation and analysis to a group of actual investment managers and equity analysts. Equity research is a multi-skilled activity combining financial, accounting, strategic, economic and communication skills. It is an ideal vehicle to put learning from the core courses to use.

A series of workshops will be delivered in the second half of Michaelmas Term. The aim of these workshops is to provide a broader introduction to equity research/valuation/modelling and the project as a whole.

The Equity Research Project offers students the opportunity to work in groups to produce an equity research report on a quoted company, with a valuation, recommendation and analysis of risk.

Good evening. I’d like to make the case for why we strongly believe that Arm presents a great opportunity to establish or add to a holding in Arm. My group was analysing Arm Holdings for the ERP. It produces semiconductor intellectual property.

Our group worked on the British Gas Group. It was a UK-based, publicly listed company.

Today, we are presenting on BG Group, with a buyer recommendation and an intrinsic value of 1650.

We believe that BG will outperform because of its higher exposure to LNG and lack of exposure to refining, which is expected to decline in the next year. We learned about the company from company reports and annual reports. And as a group, we decided what our recommendation was going to be.

We were basically responsible for finding a valuation for Marks and Spencer, and then making a recommendation on whether to buy or sell Marks and Spencer.

I was in charge of looking at the company background, the industry they’re competing in, and also reading broadly about the company, the kind of competitive pressures they were facing in the market.

A series of workshops are delivered before the project takes place. The aim of these workshops is to provide a broader introduction to equity research, valuation, modelling, and the project as a whole.

We did a fully integrated DCF model. And the modelling workshop was obviously very beneficial in being able to do that.

Financial modelling helped quite a bit. We had a workshop before starting the project. And then Simon, the director, went through what are the key points that we should be discussing.

The other modules that we did– so corporate finance, financial reporting and analysis– they all built up to the skills that we needed for the ERP project. So that was a great way to tie all the knowledge in from the first semester, together into one piece.

I don’t think we would have been doing that effectively, had it not been for the financial workshop right before the ERP.

Teams of students are required to deliver a report, which makes an active recommendation to buy or sell a stock and substantiate that recommendation. They are also required to deliver an oral presentation of their argument to an audience, including actual fund managers.

I think the panel were really insightful. The kind of questions they asked were really representative of a real client meeting in an investment recommendation scenario.

Having worked in the industry before, the Q&A with the panel of the ERP was very similar to what you do actually come across in the real world. It was fantastic to have some questions directed at us that we’d spent quite a lot of time thinking about. But then also, on the spot, to have to go back into our work and answer those questions concisely.

I think it provided a good grounding for any other situation where you’re under pressure. You have to present. And you have to be credible. So that was really amazing.

Equity Research is a multi-skilled activity, combining financial accounting, strategic, economic, and communication skills. The ERP has 2 goals. The first is to learn about the various parts of putting an equity recommendation together. The second is to learn about teamwork.

My favourite part of the ERP would have to be just the sheer knowledge that you gain. I think, just being able to look at a company from such an overview was the best experience for me, for sure.

On the one side, it was kind of working with my team members and getting an idea of what they were involved with, and how their working styles were, and kind of learning from them. The other thing I really liked about it was putting into practise some of the stuff that we’ve learned over the course as well, such as the modelling and being able to actually do that for the real world example.

When we’re sitting in class, it’s really quite difficult to get to really understand how people think. And when you come together and work on a challenging project where you need to bring in evaluation skills, communication skills, editing skills, staying up in the middle of the night skills, it really comes together really well. And you learn a lot from people.

With people who come from different backgrounds and such diverse sort of thinking and work experiences, to align on one thing and to agree with it, it’s something that I learned and you know, how to handle different conflicts that happen in a team environment.

I really feel as though we had created something of value, which we would be absolutely comfortable circulating to the investment community, and actually feeling as though you could buy equity in the company with conviction, having done that research yourself.

The MFin Programme provides many project opportunities for students. The Equity Research Project helps students get the taste of how to analyse and value a listed equity, while the Group Consulting Project is a wonderful opportunity for students to get their hands dirty on practical issues in investment, finance, or related fields.

Group Consulting Project

Takes place: Easter break

Assessment: Presentation to client.

The Group Consulting Project provides a chance for students to work on a real assignment for a host company or organisation. The project offers a great opportunity to put into practice new ideas that students have encountered on the MFin, and to get experience in sectors and roles they are interested in.

Each group is assigned a faculty supervisor and a host company manager. The project takes about 5 weeks, including pre-planning, mostly during the Easter vacation.

Every year we have projects that take place outside the UK. Examples in previous years include:

- China

- Hong Kong

- Portugal

- Abu Dhabi

- Mongolia

Going forward we aim to expand the international projects we offer.

In previous years, GCPs were hosted by companies such as:

- Amadeus Capital Partners

- Barclays

- Capital Generation Partners

- CBRE

- Citibank

- Morgan Stanley

- GIC

- IMF/World Bank

- Blackrock

While the MFin Office sources the client companies, we also welcome student-sourced projects.

The Group Consulting Project offers students the opportunity to work for a host company on a real assignment. Students will put into practise those new ideas they have encountered during the MFin and get valuable experience in the sectors that interest them.

We did our GCP with Greentech Capital Advisors, so they are a boutique investment bank operating in Zurich, New York, and San Francisco. And our project was looking at obstacles to investment in renewable energy, particularly in Northern Europe.

And we worked with the Baupost Group, which is based in both Boston in the US and London in the UK, looking at European bank deleveraging and identifying opportunities to make investments there where they become available over the next couple of years.

They’ve asked us to look into what is the specific requirements of Basel III and what will be the specific changes that we’ll bring about to this bank.

Our project was with a company called Amadeus Capital. It’s a venture capital fund based in Cambridge. They look at TMT investments at the early stage, that they have two funds, a seed fund and a later stage fund.

Well, we did our GCP for the Mongolia Growth Group. It’s a listed Canadian company that invests heavily in Mongolian real estate as well as financial services. The project was located in Ulaanbaatar. It’s the capital of Mongolia.

This project actually– we sourced it through– I sourced it through the programme. I’ve been interested in value investing for some time, and we, as a group, we decided that we do a project in investment management. And so essentially, Baupost, they had a speaker from the company come to us as part of the City Speaker Series, and essentially after the dinner, I approached them. And we said that we have this team. We’d be interested to do a consulting project for you, and they agreed. And so it was a great story.

Each group is assigned a faculty supervisor and a host company manager. The project lasts five weeks, including preplanning, and mainly takes place during the Easter vacation.

We were thrown into the deep end with trying to identify these opportunities in Europe. I come from Australia, and I haven’t had much exposure to the European market.

And the scope of our project was to primarily look at non-mining investment thesis in Mongolia, for example, real estate, infrastructure, capital markets, and as well as that, we also engaged in stakeholder interviews.

This is a terrific experience because we have five group members in this group. We come from very diverse cultural backgrounds geographically and also from different, like, working backgrounds. So it’s kind of a mutually beneficial experience for us.

In previous years, students have been hosted by Citibank, Schroders, 3i, BlackRock, Capital Generation Partners, Newton Investment, Warburg Pincus, Macquarie, Amadeus Capital Partners, and many more.

Our project was very relevant and cutting edge. I think it’s a very topical subject. We had the opportunity to have very high-level conversations with the interviewees. On the top of that, we had the ability to put our ideas very condensely into a presentation and present it to our client.

The project was a great opportunity to actually work and do something real and tangible for a company, as opposed to the academic coursework. So we gained great client relationship skills, and we got a sense for what clients, and especially hedge funds, are looking for.

It’s very exciting. It’s very dynamic. It’s very unexpected. It’s full of surprises. And it’s such an exciting opportunity to be able to carry the Cambridge name overseas and speak to people. And it’s surprising how many doors that opens.

This experience, in terms of my future work, has been very beneficial and rewarding to have a face-to-face talk with the clients. And to really learn what is going on in the marketplace and industry has been really beneficial.

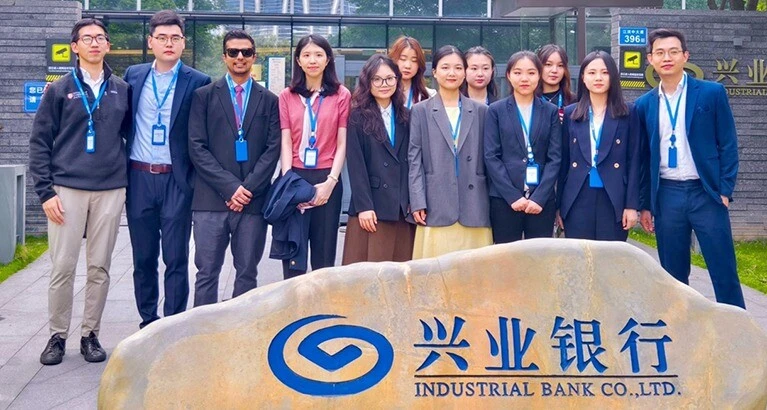

Participating in the Group Consulting Project with the Industrial Bank of China has been an incredible opportunity to collaborate with students from around the world, including South Africa, Indonesia, Canada and China. This once-in-a-lifetime experience has significantly enriched both my personal and professional growth. I am deeply grateful to the MFin team for providing this unique and transformative opportunity.

Optional Individual Project

Takes place: July/August

This is an optional project spent gaining work experience at a financial institution or completing a research dissertation. This project is deliberately flexible to accommodate the varying needs of students.

The project is an opportunity to do a reasonably long and substantial piece of research of around 5,000 words. Options include doing a purely academic piece of research, doing a piece of research based on external interviews and/or other data, or doing a piece of research linked to an internship for a host organisation.

The last option can be used as a device to network and interview people in any area of finance that would be useful for job-seeking. While you’re a student of the University of Cambridge, you can request an interview of all sorts of people as part of a research project.

All students must have an academic supervisor to mark and provide guidance on the project. The supervisor must be a faculty member of the University, or an external who is a fellow or associate of Cambridge Judge Business School. The Individual Project will be marked by the supervisor. However, this mark will not be included in the overall mark for the MFin.

Read more about the MFin projects

From useful information articles to case studies, explore the Cambridge MFin projects.

Student and alumni news

Innovative solutions for a green transformation: our MFin Group Consulting Project

The Group Consulting Project (GCP) is a key component of the Cambridge MFin degree. The project gives students the opportunity to apply their theoretical knowledge to real-world financial challenges. Here, Zubair Verachia, Juan Untung and William Huang, share their experience and insights into the Group Consulting Project.

Programme news

The Equity Research Project: learn how to research and present a stock investment recommendation

The Equity Research Project is an opportunity for students to put the knowledge and skills they have learned on the MFin into practice by preparing an investment thesis and recommendation on a listed company. Here we find out more about the project.

The Group Consulting Project (GCP) is one of the highlights of the MFin programme for many of our students, providing the chance to work on a real-life project with a client of their choice. So what’s it all about?